In a world where cash flow speed and payment behavior can shift overnight, finance leaders need more than static monthly reports. Ropo OneView™ brings your entire invoicing and payment flow into one clear, real-time view – helping you spot trends, control risks, and make data-driven decisions with confidence.

Whether you’re a CFO optimizing working capital, a controller tracking performance, or a credit manager monitoring risk, Ropo OneView™ delivers the insights you need – when you need them.

What is Ropo OneView™?

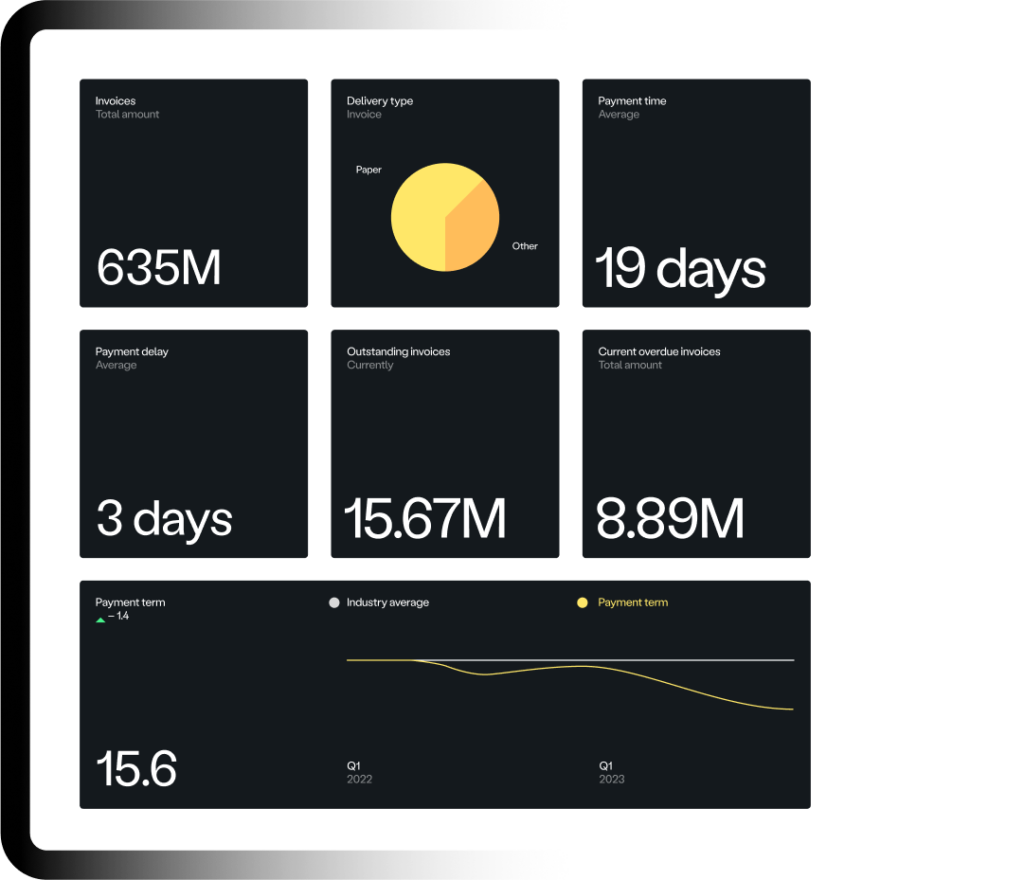

Ropo OneView™ is an integrated business intelligence solution built directly into the Ropo One™ platform. It transforms invoicing and payment data into intuitive dashboards and KPIs, giving you an instant overview of performance across the full receivables lifecycle.

Designed for finance teams, controllers, and company management, Ropo OneView™ provides a single, 360° window into the metrics that matter most – from Days Sales Outstanding to customer payment behavior, open receivables, and service quality.

Why it matters

Instant financial clarity. See your entire invoice lifecycle – from delivery to payment – in one place. No more fragmented reporting or manual reconciliation. Ropo OneView™ continuously analyzes data in real time, so your dashboards are always up to date.

Smarter decision-making. Monitor DSO, payment delays, digital invoicing rates, and open receivables to identify bottlenecks and improvement opportunities. Use filters to drill down to specific segments, companies, or even individual customers.

Improved risk control. With payment behavior insights, credit risk indicators, and – in the Pro version – enriched third-party data, you can anticipate issues early and react faster. Monitor changes in payment patterns before they become problems.

Reliable forecasting. Forecast cash flow based on due dates and historical payment behavior. Or take it further with Ropo OneView™ Pro and its AI-powered Smart Forecast engine for more accurate, intelligent predictions.

Benchmarking and trends. Compare your performance with industry averages and follow trends over time to understand where you stand in a broader market context. Identify best practices and areas for improvement.

Key features at a glance

Ropo OneView™ brings together the most important metrics in easy-to-use dashboards:

- 360° Overview Dashboard: Essential KPIs for cash flow, payments, and service quality at a glance.

- Days Sales Outstanding (DSO): Track payment times, delays, and trends across customer segments.

- Lifecycle Performance: Analyze success rates across invoicing, reminders, and collection phases.

- Open Receivables: View current open capital, overdue statuses, and forecasted payment dates.

- Customer Service Metrics: Understand contact volumes, resolution times, and customer satisfaction.

- Delivery Insights: Analyze invoice delivery channels and their impact on payment speed and DSO.

- Credit Risk & Smart Forecast (Pro): Advanced analytics with third-party data and AI-powered predictive cash flow modeling.

All dashboards include drill-down functionality, allowing you to move from high-level summaries to segment, company, customer, or even invoice-level details.

Who benefits from Ropo OneView™?

Ropo OneView™ is designed for the entire CFO office and company leadership:

-

CFOs and Finance Executives: Strategic visibility and planning with real-time financial data.

-

Controllers: Detailed performance analysis and variance monitoring.

-

Credit Managers: Risk monitoring and payment behavior insights.

-

Shared Service Centers: Consolidated group-level reporting across multiple companies.

Whether you manage one company or an entire group, Ropo OneView™ can be configured for both single-profile and group-level reporting, giving you the flexibility to view data at the level that matters most.

Two versions to fit your needs

Ropo OneView™ covers the essentials for monitoring, analyzing, and optimizing your invoicing flow. It includes all core dashboards and KPIs – from DSO tracking to lifecycle performance and open receivables.

Ropo OneView™ Pro takes it further with advanced features for smart cash flow forecasting and risk management. It includes third-party data for business customers, AI-powered forecasting, and enhanced credit risk analysis – giving you even deeper insights for strategic decision-making.

Control, forecast, and optimize with Ropo OneView™

Ropo OneView™ is more than a reporting tool – it’s a strategic asset for finance teams who need to stay ahead. With real-time data, intelligent analytics, and industry benchmarking, it helps you make better decisions faster.

Ready to transform your invoicing operations?

Ropo One™ provides end-to-end automation for your entire invoicing lifecycle – from invoice creation and delivery to payment monitoring and collection processes. Our comprehensive platform delivers the automation benefits discussed in this article: improved cash flow, reduced manual work, standardized processes, and full visibility across your invoicing operations.

Our expert implementation team works with you to determine the best solution for your specific needs and industry requirements. Thousands of Nordic companies already trust Ropo to handle their invoicing automation.

Contact us to learn how Ropo One™ can beat financial friction and create smoother business flows for your organization.

Read more

Ingen innlegg funnet

Logg inn

Logg inn Logg inn

Logg inn